This blog post is the English version of a previous blog post.

Hello, I’m Uzumero as a Japanese salaryman (X account ).

I would like to disclose and analyze my total assets as of the end of March 2024.

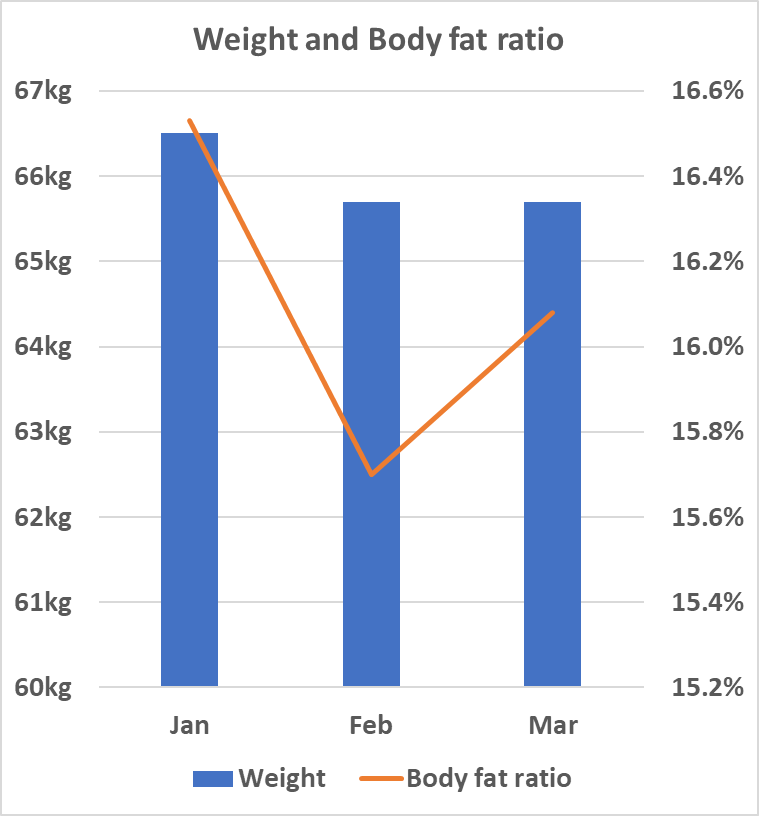

I consider my health to be part of my assets, so I am also disclosing my monthly weight, body fat percentage and sleep time.

- Total assets: [ 50.35 million yen ] ⇒ [ 51.88 million yen ] (+1.53 million yen (+3.04% ))

- Risk assets: [ 42.13 million yen ] ⇒ [ 43.81 million yen ] ( +1.68 million yen (+3.98% ))

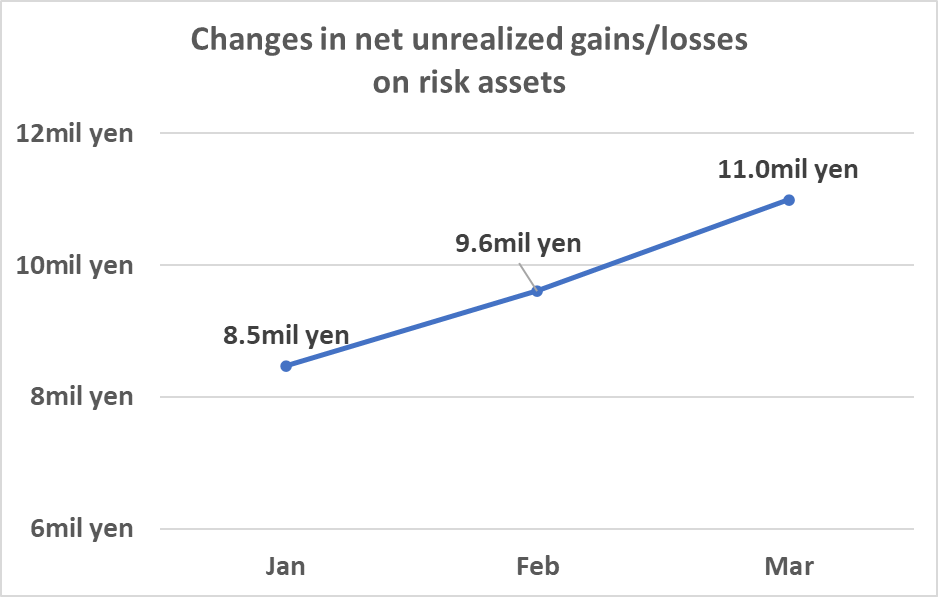

- Valuation profit/loss: [ 9.6 million yen ] ⇒ [ 10.99 million yen ] (+1.39 million yen (+14.4% ))

- Risk-free assets: [ 4.7 million yen ] ⇒ [ 5 million yen ] (+300,000 yen (+6.38% ))

- Standby funds: [ 3.52 million yen ] ⇒ [ 1.57 million yen ] ( -1.94 million yen (-55.4% ))

- Life defense fund: [ 0 yen ] ⇒ [ 1.5 million yen ] ( +1.5 million yen )

- Weight (body fat percentage): [65.7 kg (15.7%)] ⇒ [65.7 kg (16.08%)

- Average sleep time: [7 hours 48 minutes] ⇒ [7 hours 49 minutes] (data from Pokemon Sleep)

Total assets (as of March 31, 2024)

Total assets as of the end of March 2024 were…

51,883,101 yen!

This is an increase of 1,528,730 yen over last month!

Converting total assets to dollars, it would be about $340,000 (converted to 152 yen to the dollar).

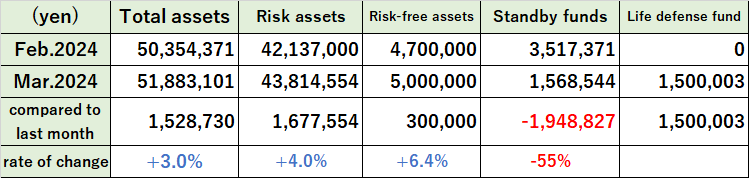

The breakdown last month is as follows.

| Total assets (yen) | Risk ssets (yen) | Fisk-free assets (yen) | Standby funds (yen) | Life defense fund (yen) | |

| Feb.2024 | 50,354,37 | 42,137,000 | 4,700,000 | 3,517,371 | 0 |

| Mar.2024 | 51,883,101 | 43,814,554 | 5,000,000 | 1,568,544 | 1,500,003 |

| conpared to last month | 1,528,730 | +1,677,554 | +300,000 | -1,948,827 | +1,500,003 |

| rate of change | +3.0% | +4.0% | +6.4% | -55% |

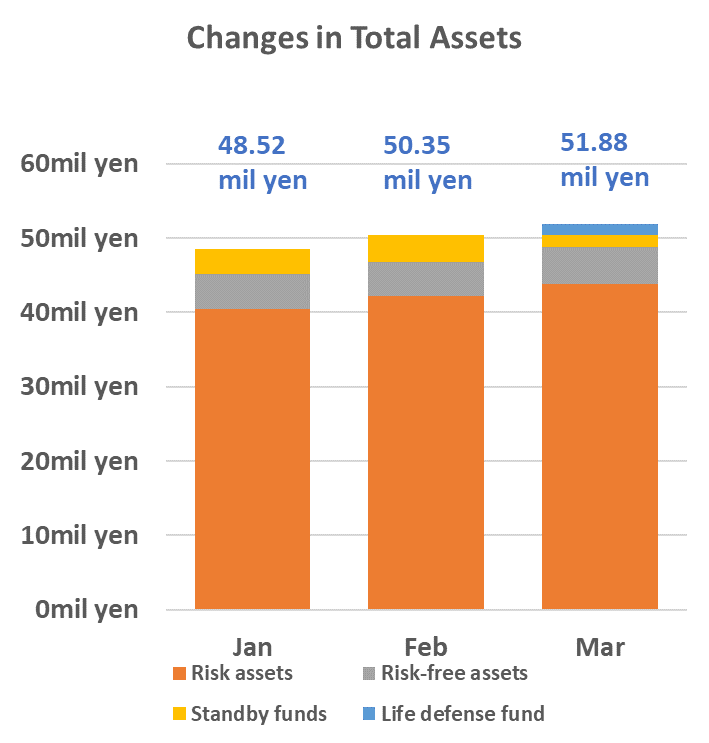

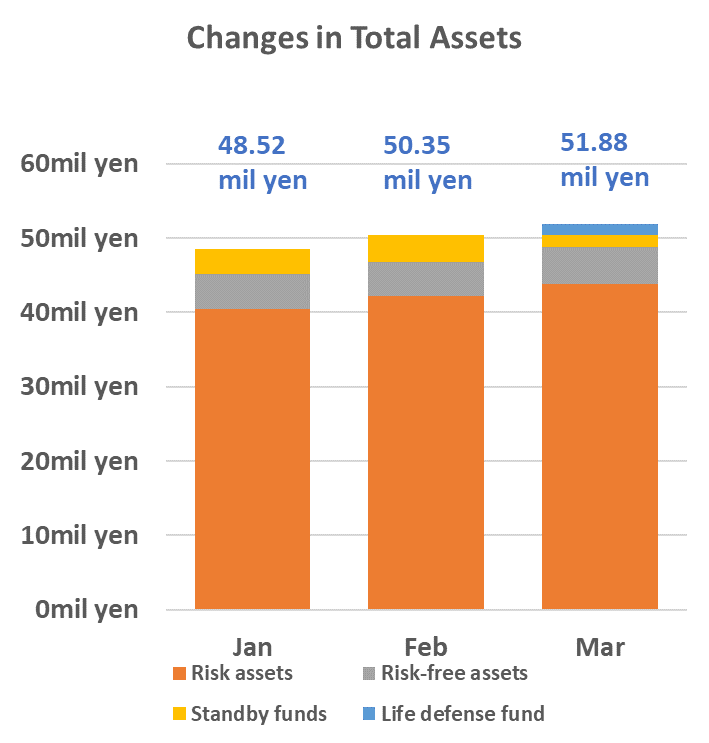

The changes since January 2024 are as follows.

Total assets increased from [ 50.35 million yen ] in February to [ 51.88 million yen ], an increase of approximately 1.53 million yen (+3.04%) in one month.

Until last month, the standby fund included the life defense fund, but from this month it is a separate category.

I am relieved that I was able to keep my total assets at 50 million yen from last month.

Of the 43.81 million yen in assets at risk, unrealized gains amounted to approximately 10 million yen.

Next, I will present the details of the change in the breakdown.

Change in Risk Assets in March

Risk assets (valuation) increased approximately 1.68 million yen (+3.98%) from [ 42.13 million yen ] to [ 43.81 million yen ]. The ratio of risk assets to total assets increased from 83.7% in February to 84.4% in March.

The net amount of purchases and sales of risk assets this month was approximately 275,000 yen. So, the increase in valuation gains/losses (unrealized gains) resulted in an increase in risk assets of approximately 1.4 million yen.

The following figure shows the change in unrealized gains/losses on risk assets since January. Unrealized gains exceeded 10 million yen.

My risk assets are over 95% stocks (the remaining 5% are REITs, etc.). This can be considered the result of benefiting from the rise in global stock prices.

Change in Risk-Free Assets in March

Risk-free assets were increased to 5 million yen this month.The following shows breakdown of risk-free assets.

- Government bonds for individuals「10-Year Floating-Rate」【1.5 million yen】

- Rakuten Bank Money Bridge【3 million yen】

The purchase amount and interest rate for my current holdings of Government bonds for individuals (10-Year Floating-Rate) are as follows

| purchase amount | Interest Rate (before tax) | |

| No.167(Feb) | 1,000,000yen | 0.49% |

| No.168(Mar) | 500,000yen | 0.47% |

Rakuten Bank accounts with Money Bridge setup will earn 0.1% (before tax) up to 3 million yen (as of 4/2/2024).

Changes in Standby Funds

Standby funds (cash) decreased from 3.52 million yen to 1.57 million yen ( -1.94 million yen ).

Since I unexpectedly purchased risky assets this month, my cash has decreased, and I would like to increase my standby fund in the future.

Health assets (weight, body fat percentage, sleep duration)

The most obvious indicators of health are considered to be [ weight ], [ body fat percentage ], and [ sleep duration ].

Bodyweight and body fat percentage are factors related to various diseases and lifestyle-related diseases. In addition, less [ sleep time ] can have a serious impact on physical and mental health, including daily vitality and mental health.

It is meaningless if you have saved money while in your 40s, but your health is compromised in your 50s and 60s. Therefore, I also disclose [weight], [body fat percentage], and [sleeping hours] as indicators of healthy assets.

Weight and body fat percentage

Weight and body fat changes through March were as follows.

Weight was almost the same value as in February. Body fat percentage has increased a little, but I would like to believe that it is an error…

I felt like I ate quite a bit of food on my trip in March, but I am relieved to see that my weight seems to reflect this. I hope to maintain my current weight in the future.

Sleeping Time

The average amount of sleep in March was [7 hours 49 minutes] per day. Compared to last month, this is an increase of 10 minutes. This data is from Pokemon Sleep, but I go to bed around 11:00 and wake up around 7:00 every day, so I don’t feel it is so wrong.

I would like to sleep a little more as a physical sensation, but I hardly feel sleepy during the day and I don’t have a bad night’s sleep, so I will be careful not to reduce it in the future.

Summary and Future Policies

In this issue, I disclosed the total asset situation as of the end of March. The Nikkei 225 hovered around 40,000 yen and reached new highs. I also benefited from the increase in the Dow and S&P500 indexes, resulting in a large increase in total assets [ +1,530,000 yen] in one month.

Last month also resulted in an increase in assets of about 1.6 million yen, resulting in an increase in assets of about 5 million yen this year compared to the end of the previous year.

An investment of about 40 million in stocks would have a tremendous impact on the stock market.

Of course, if stock prices were to drop, my assets would be substantially negative…

Going forward, I plan to increase my regular index accumulation as it is now, as well as Government bonds for individuals (10-year) and cash as risk-free assets.

I will consider purchasing high-dividend stocks and individual stocks if there is a sharp decline.

As for healthy assets, I believe that I am keeping my weight, body fat percentage and sleep time in good condition, and I will make efforts to continue to do so. Currently, I am doing some muscle training in hopes of increasing my muscle mass a bit more.

Thank you again for reading this issue.

Bitcoin・FX・個別株のデイトレで大損失(損失400万円+メンタル不調)、デイトレで心身に不調が出てきたので2021年から長期のインデックスと高配当株投資に切り替え。資産や家計簿をブログやXで発信中||最終学歴:博士後期課程修了|学位:Ph.D. 博士(学術)|40代サラリーマン(専門職)|手取年500万円|総資産5500万円|含み益1200万円|投資歴15年以上|育休取得予定。

コメント